Office buildings have sat largely quiet for two years now thanks to the COVID-19 pandemic. Today, though, the move is on to bring many of these workers back, at least in a hybrid mode in which they work some days from the office and others remotely.

But what do these workers want when they return to the office? What are they looking for from their employers to make the return to the office as stress-free and productive as possible?

Steelcase, the national manufacturer of office furniture, attempted to find out in a report released in February of this year. The report, The New Era of Hybrid Work, surveyed 5,000 workers in late 2021, asking them what they wanted to see in the layouts and functionality of their offices in 2022 and beyond.

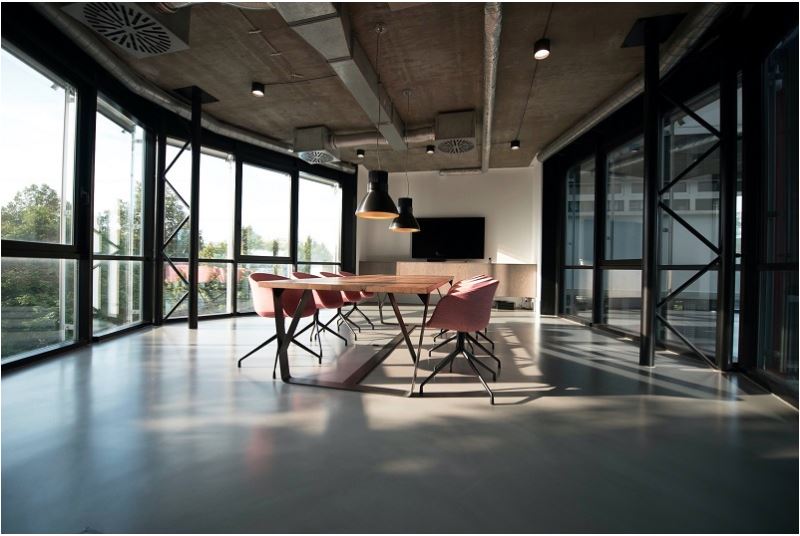

The results? Steelcase found that workers want private dedicated workspaces and aren’t happy with completely open office plans. They also want their offices to offer a variety of spaces that support individual work and in-person and virtual collaboration for small and large groups.

Workers are also interested in offices that feel more like home, providing comfortable furniture and greater control over where they perform their work.

Midwest Real Estate News recently spoke with Chris Congdon, director of global research communications with Steelcase, about the results of the survey and the steps companies and office owners need to take to boost the productivity of workers as they return to the office.

Here is what he had to say.

Let’s start with the important question: How would you describe a hybrid workplace?

Chris Congdon: A hybrid workplace is about empowering people to work from diverse locations. Different organizations will have different policies regarding the frequency of when they expect people to work in company offices or their own home offices. Right now, as people come back to the office, that will be fluid. What’s important, though, is that the workspace be designed to support this kind of work. A few fundamental factors need to change from the way office has been set up in the past.

What are some of those changes?

Congdon: At the highest level, you are trying to achieve equity. You want the people who are in the office and the people who are home to all be having a similar experience. You don’t want to compromise part of your employee base depending on the locations from which they are working. The second big factor is engagement. Companies need to recognize that people engage in different ways based on the medium in which they are working.

Consider that during this interview, we are all on Zoom. But not everyone has cameras on. In a lot of organizations, you have people working in an office and people who are on video. If I were to feel that I am not a full-on equal participant in a meeting because I am on video, I might be quieter. I might spend part of the meeting checking emails, tuned out and not engaged.

How can companies create that equity once people are working both from home and in the office?

Congdon: First, it has to be easy for people to do whatever it is they have to do throughout the day. Anything that creates friction for people causes them to resist. A workplace supporting hybrid work has to solve for those issues.

The way offices are set up can help with this. If more people are attending meetings on video, not everyone will be gathering in a big conference room. Instead, people can gravitate to spaces where they have higher levels of acoustical privacy. They can head to enclaves and enclosed spaces that have four walls and a door. You are going to see more people in the workplace needing those spaces.

That is the number-one thing people asked for in our survey: private spaces. That is more important now than before the pandemic. In our survey, 64% of respondents said they need places to do this hybrid collaboration. If companies want to support that equitable experience, they need to offer these spaces.

What else do people want to see from their workplaces as they return to the office?

Congdon: There is an increased demand for privacy. Even before the pandemic, there was a pushback against the open office plan. The way the open plan was interpreted by a lot of organizations was that everything was wide open. People were shoulder-to-shoulder. They were at benches. There was not a place to escape and get any kind of privacy, whether you needed to focus or needed to make a personal phone call.

The push against that was happening before the pandemic. Now you have sent people home for two years. During this time, 70% either had a dedicated private office or were able to take over a guest room or some other space that became their private office. Contrast that with what people have in the office. More than 50% of people are sitting in open workspaces. After two years, people have more control over privacy at home than they do in the office. As they migrate back to the office, they expect spaces with higher levels of privacy. People want that privacy when they come back.

They also want more work furniture that can either be moved easily by the user or by the installer. The demand is for less of a focus on permanence and more on flexibility.

How about safety measures? Are people worried about their safety with COVID and a return to the office?

Congdon: That does continue to be one of employees’ concerns. They want good air quality. There is less of a focus on material surfaces and more on air quality as we have learned more about COVID. Overall, employees have a heightened expectation that the workplace should be a place where you should be able to feel relatively safe from picking up crud, whether that’s a cold and flu or COVID. Organizations that are smart and savvy will focus first on their indoor air quality, on improving ventilation and filtration. They want to be able to say with confidence that they are providing a good turnover of fresh air for the people in their workplace. If they can’t do that, they’ll have to at least find more space for room-based air-purification systems or even personal ones.

Will companies use the improvements to their office space as recruitment tools?

Congdon: They already are. You can see where the investments are going. Organizations recognize that they have to earn people’s commutes. If people have alternatives, you can’t expect them to make those commutes for the same old thing they left behind two years ago. Organizations are very seriously looking at creating spaces that are checking all the boxes: inspiring, safer, designed specifically to suit the kind of work people are doing today.

The pandemic challenged our traditional assumptions about the way things are or might work, and that’s true, too, in the office.