Commercial real estate services have evolved to include everything from space planning and data analytics to incentives negotiations. But in the early days, it was a simple matter of development and leasing. It’s hard to convey the huge impact the advent of tenant representation—and the unlikely disruptor who helped pioneer it—has had on the industry.

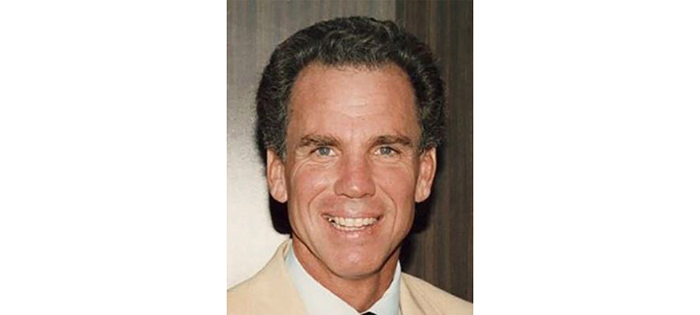

Heisman Trophy winner Roger Staubach was a 27-year-old rookie when he joined the Dallas Cowboys in 1969, after keeping his commitment of service to the U.S. Navy. Earning a salary of just $25,000, he began looking for work in the offseason. A Naval Academy friend connected him with the Henry S. Miller Co.

Staubach joined in 1970, working briefly in its insurance division until he talked firm leaders into letting him get involved on the real estate side of things. “I worked every offseason until I decided that I wanted to make real estate a future for me, outside of football,” he says.

After learning the ropes at Miller, Staubach joined developer Robert Holloway in a boutique venture in 1977. He retired from football in the spring of 1980, and two years later formed his own firm, The Staubach Co. It was an amicable split; Holloway wanted to focus on development, and Staubach wanted to build a company around his interest in representing tenants. Click to read more at www.dmagazine.com.