BY CHARLES E. GILLILAND, PH.D, TEXAS A&M REAL ESTATE CENTER

Reprint from Texas Rural Land Value Trens 2017/ Annual Outlook for Texas Land Markets

Rebounding activity in the oil patch reinvigorated the statewide land market. Posting a surprisingly strong year end result at $2,644 per acre, a 4.46 percent expansion from 2016 prices and the strongest growth since 2014. The 6,272 reported sales topped 2016 totals by 577 sales.

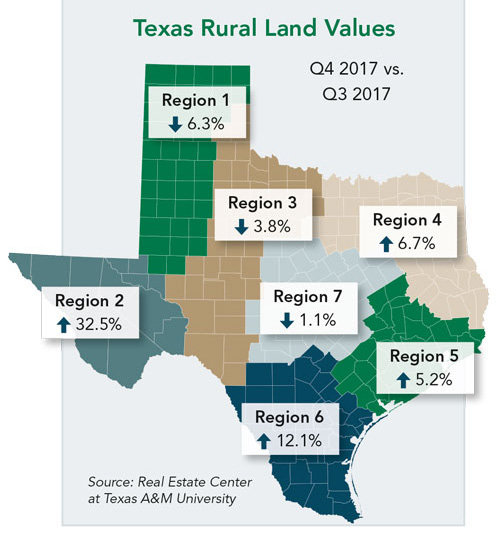

Driven in part by remarkable developments in energy-dominated areas, overall Texas statewide results continued to post price increases. However, market conditions in some regions varied where weak results pointed to market adjustments in three areas: the Panhandle and South Plains, West Texas, and Austin-Waco-Hill Country where prices ebbed for various reasons.

Click here to read more.