Meredith Cullen has been interested in the Texas land market since he was a kid, driving around to scout tracts with his father Roy.

“That’s what my dad was into and that was his talent: finding out where the path of growth is,” says Cullen, who leads Cushman & Wakefield’s land brokerage team in Houston along with David Cook.

Roy passed that talent and passion to Meredith, who’s using it to ignite what is already a red-hot market.

“It’s on fire,” Cullen says. “Right now, there’s a lot of opportunity.”

That opportunity only exists if you know where to look like he does. Even then, it’s become a challenge in the past year.

“If I could find 500 acres maybe 10 miles past the Grand Parkway between I-45 and US 59, I could sell that all day long for $50,000 an acre,” says Cullen. “Right now, it’s just hard to find that product.”

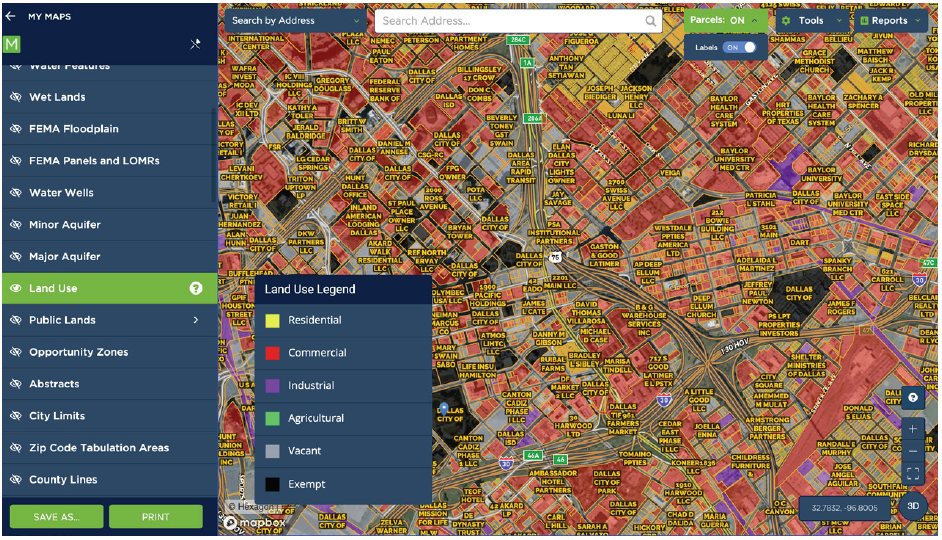

What’s driving the demand? He describes it as a perfect storm of behaviors generated by and during the pandemic. First, we all know about the exponential increase in online buying, which created a need for last-mile distribution locations.

“I have a lot of clients looking for industrial land go off-market to try

to find these pieces,” Cullen explains. Click to read more at www.rednews.com.