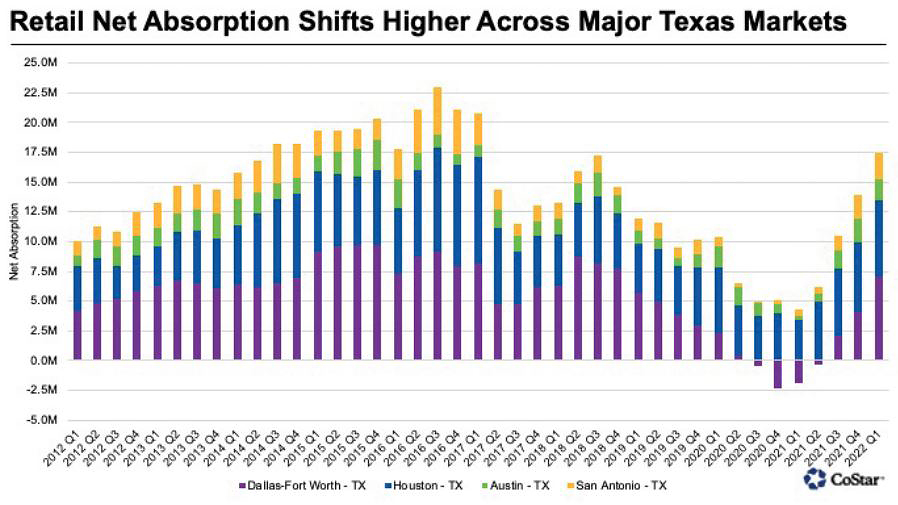

The “Texas Miracle” that defined the economic prosperity of the Lone Star State has cut a wide swath across all asset types. Beyond the pandemic, no asset type has realized more seismic changes in recent years than retail. From disruption in technology to consumer preferences, the space devoted to purchasing goods and services continues to evolve. While Texans share a common bond, the retailers and real estate community in every region of the State have had a unique experience navigating the choppy waters left by the pandemic.

Austin

Austin’s retail market remains on firm footing. Vacancies fell to about 3.5%, well below the national average of 4.5%, and are among the top-10 lowest in the country. The market has seen some of the strongest demand over the past year, with about 2 million square feet absorbed despite disruptions from COVID-19 variants. Substantial population and economic growth have kept the market strong over the past few years.

Swift action by Congress to get money in the hands of individuals and PPP loans into the hands of businesses helped keep the market afloat during the early days of the pandemic. However, the market hasn’t been kept strong just due to government stimulus. Significant expansions in the tech sector, wage growth, and household formation have buoyed retail prospects. Consumers have resumed normal spending patterns, driving leasing activity to within a short distance of pre-pandemic norms. Click to read more at www.rednews.com.