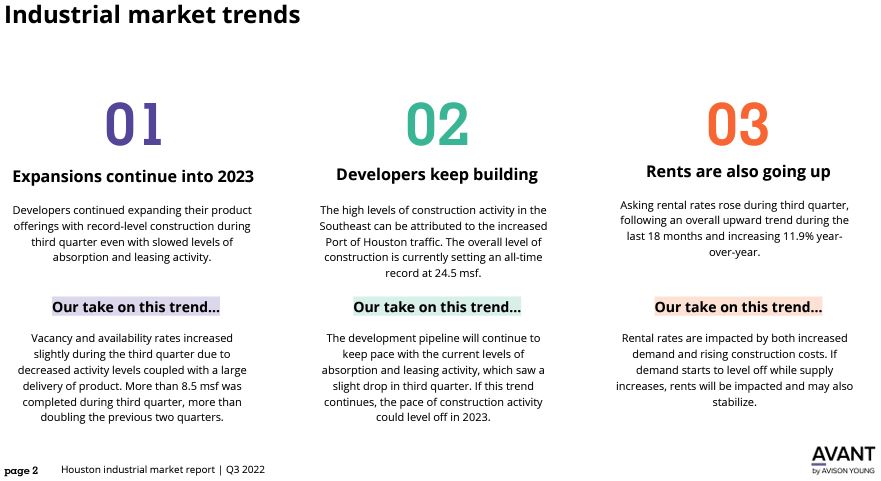

City living comes with cons—and for many, it’s sacrificing square feet. Fortunately for the self-storage sector, less space in the home means more is needed outside of it, causing an increase in storage units near multifamily hotspots.

The decade marked high construction volumes across the U.S., with almost 350 million square feet of storage space delivered from 2012 to 2021, 22% of overall existing inventory. Over the same time, 3.1 million new apartments in 50+ unit buildings were added, and 427,000 new rentals were added to the national market last year alone. But not all metros were created equal—RentCafe and YardiMatrix recently analyzed the country’s largest metros to identify the places self-storage is doing the best, in correlation with a growing apartment market. Chicago was No. 4.

From 2012 to 2021, Chicago added 11.5 million square feet of storage space and almost 72,000 multifamily units, reaching a peak for self-storage construction in 2016 with 2.1 million square feet of space delivered. Yet it’s just the start of what’s to come.

Developers are currently amping up their construction efforts to keep up with demand, despite economic challenges, with 2.6 million square feet of storage space currently planned and under construction.

Still, Chicago’s numbers are low in comparison with metros like Dallas and Houston. People continue to relocate to the Lone Star State from hubs like San Francisco, New York City, and even Chicago, bolstering its economy more and more.

One of the most popular relocation destinations in the country—Dallas-Fort-Worth-Arlington—saw a 17% population growth over the past decade, based on the report, leading, naturally, to increased demand for both housing and self-storage, and the market was quick to respond. Nearly 200,000 new apartments and 20+ million square feet of storage space was delivered during the decade, the most in any metro across the U.S.

Of course, Dallas’s quick recovery post-pandemic allowed for the resuming of construction much sooner than other markets. Almost 2.4 million square feet of new storage space and 26,000 new apartments delivered in 2021, according to RentCafe.

As for Houston, RentCafe also found that young professionals continue to flood in with the likes of Hewlett Packard, Maddox Defense, Axiom Space and Sun Haven relocating to the metro in the past few years alone, resulting in 15 million square feet of new storage space and 142,000 apartments delivering during the decade.