Speaker: Bruce Rutherford, International Director JLL

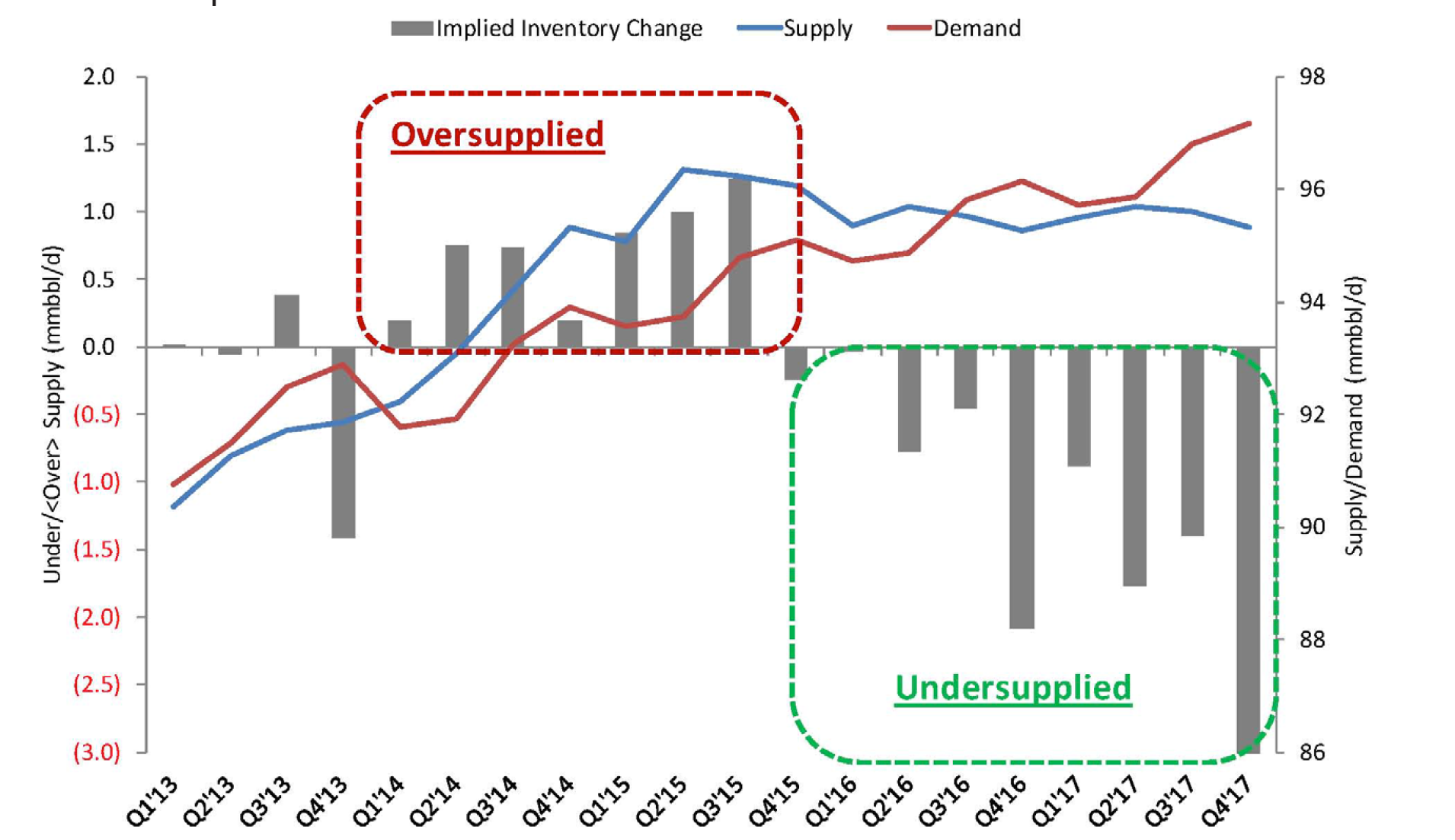

Takeaway: Houston office market will suffer extereme weakness in those submarkets depending on the Energy Sector. The Energy Corridor, Greenspoint, Westchase, & The Woodlands. less pain in the CBD, but still some, and some in the Galleria. Oil prices should be in the $60-62 per range by end of 2016, but will have to stabilize for a period of many months before any new hiring by oil companies. Mergers & acquisitions and bankruptcies will continue to throw sub-lease spcae into an already glutted market in these submarkets.