Although The Woodlands area holds the reputation of being a retail destination in the Greater Houston area, local experts say the area’s retail rental rates remain on par with those of neighboring communities, while local business owners say the rental rates can be discouraging to small businesses.

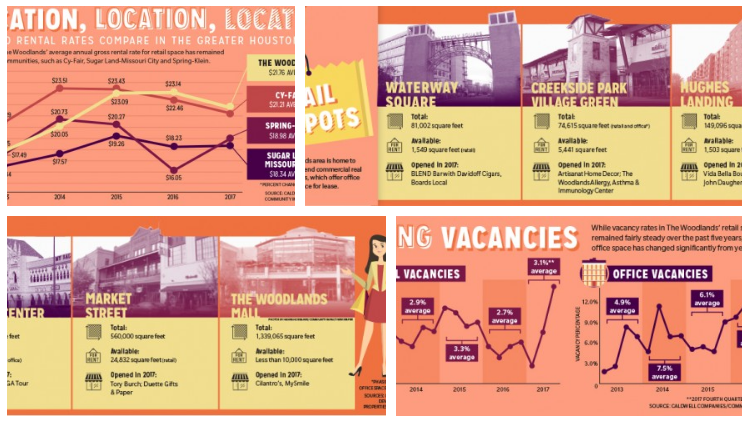

In 2017, The Woodlands’ average retail rental rate was $21.76 per square foot—making the community the 13th most expensive retail rental market in the Greater Houston area, according to data compiled by J. Beard Real Estate Company’s research department through third-party data providers.

Compared with similar Greater Houston area markets, retail in The Woodlands is more expensive than Cy-Fair, at $21.21 per square foot; Spring-Klein, at $18.98; and Sugar Land-Missouri City, at $18.34, according to data compiled by Caldwell Companies.

Read more at communityimpact.com