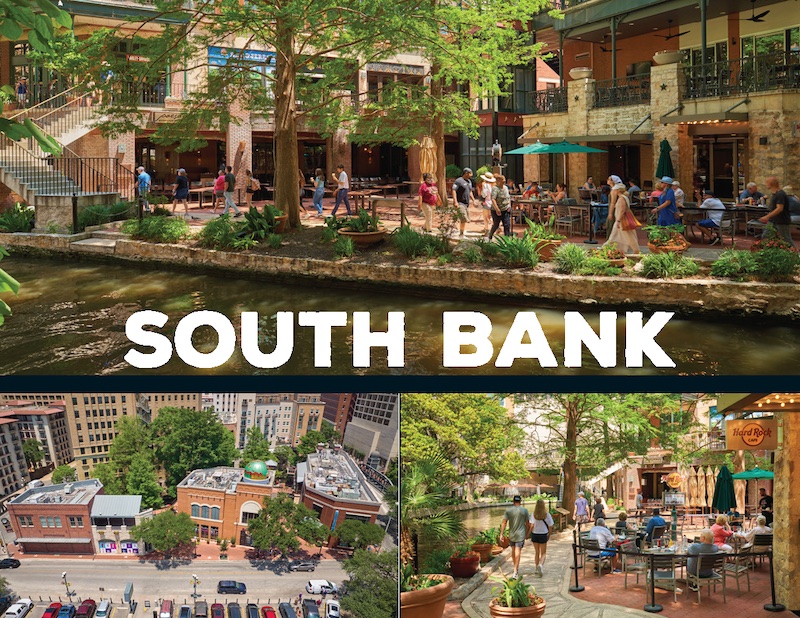

JLL Capital Markets has closed the sale of South Bank, a 46,704-square-foot, high-performing retail asset located on the world-renowned San Antonio River Walk, the top tourism attraction in Texas.

JLL marketed the property on behalf of the seller, and Fifth Corner acquired the asset. Fifth Corner’s predecessor, AMREIT, formerly owned this property from 2005 to 2015.

This trade is significant as only one River Walk retail asset transaction has occurred over the last five years, and only six individual retail assets have traded since 2005.

Featuring a strong mix of food and beverage and local and national retailers, the property caters to the over 11 million visitors to the River Walk annually. South Bank generates total commerce of over $22 million, the center is 100% occupied and boasts an average tenant tenure of 20.1 years. Original tenants include Hard Rock Café, The County Line Bar-B-Q, Paesanos, Cowboy’s Alamo City Harley-Davidson, Ben & Jerry’s and Howl at the Moon. Recent additions include Merkaba, a live-music sister concept to Howl at the Moon, and Fat Tuesday, which has returned to its original South Bank location after 17 years.

Situated at 111 W Crockett St., South Bank is set within a highly coveted retail micro-market. The tenants have access to a San Antonio’s population of 2.6 million, as well as the approximately 37 million tourists that visit the city annually. Additionally, the location of the asset benefits from the 16,877 total hotel rooms within a five-mile radius. South Bank is also supported by incredibly strong fundamentals driven by high retailer demand and development restrictions established by the RIO-3 zoning that was implemented in 2002 to protect, preserve and enhance the San Antonio River.

The JLL Retail Capital Markets Investment Sales and Advisory team that represented the seller was led by Senior Managing Directors Chris Gerard, Ryan West and Barry Brown and Associate Erin Lazarus and Megan Babovec.