The Dallas-based office of Trez Capital announced the closing of a $17 million loan for the financing of phase one to develop 360 lots of Centurion American’s new master-planned community, Cottonwood. Close to the Texas-Oklahoma border, the 100-plus acre community located in Dorchester, just north of Gunter and Celina, will be near Texas Instruments’ new manufacturing plant, a business park being created by Texas Instruments, Finisar and other large corporations.

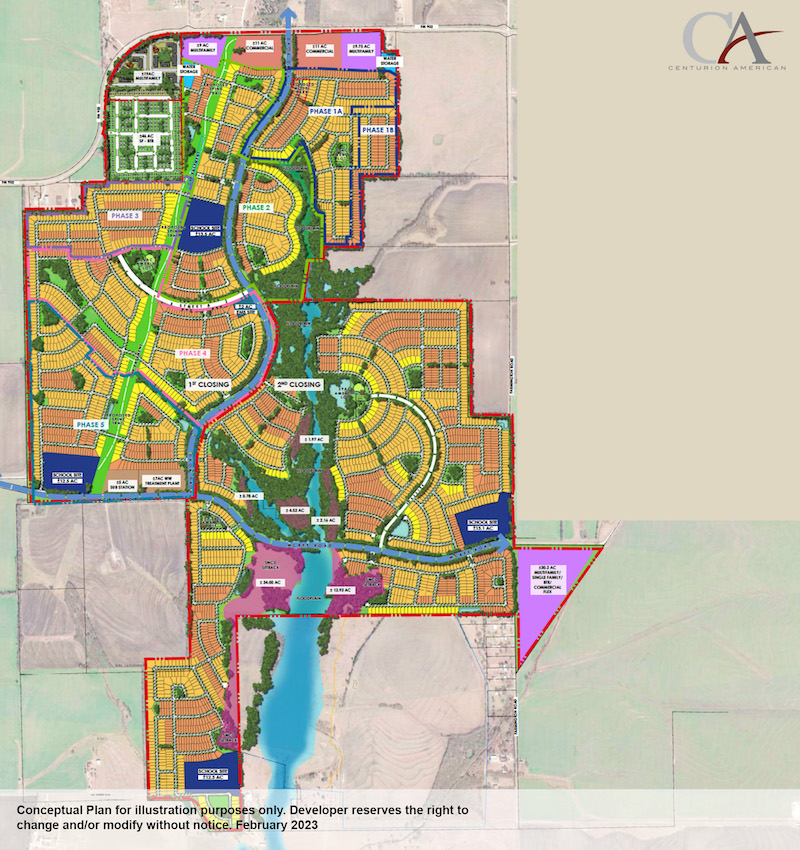

Cottonwood will offer over 2,000 lots that will serve a diverse range of community options and amenities including multifamily residences, commercial use, build-to-rent options, multiple school sites and nature trails throughout. The community sits 55 miles from Downtown Dallas and is in proximity to large corporation headquarters, providing amenity-rich, nearby housing for workers with families.

The phase one lots are expected to be completed in 2025.