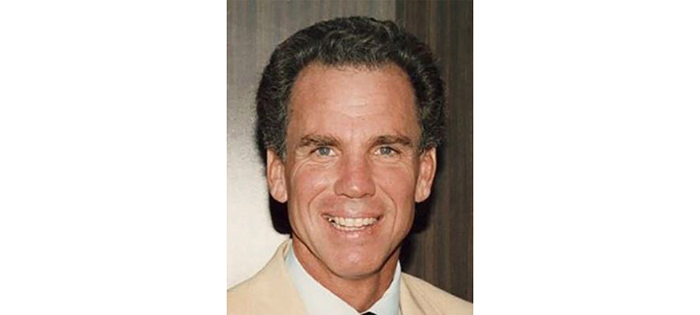

DALLAS, TEXAS, March 22, 2022 (GLOBE NEWSWIRE) — Cherry Petersen Landry Albert LLP is pleased to announce that Thomas O. Anderson, Jr. has joined the firm as Senior Counsel. Anderson’s practice is focused exclusively on commercial real estate transactions.

Anderson has a wide-ranging real estate transaction practice, representing sellers, purchasers, and lenders in commercial real estate throughout Texas and nationwide. He has extensive experience with real property title and survey matters due to his time as a licensed escrow officer. Thomas also regularly represents landlords and tenants in commercial lease negotiations.

“I have thoroughly enjoyed getting to know and providing counsel to the firm’s real estate clients” said Thomas Anderson, Senior Counsel at CPLA. “The firm has a strong and supportive culture and a tremendous team of lawyers, paralegals and staff.”

“I’ve known Thomas Anderson for a long time and I’m delighted to have him join us here at CPLA,” said Kevin Cherry, Partner at the firm. “His experience in real estate acquisitions and commercial leasing provides real value to CPLA’s clients.” Click to read more at www.globenewswire.com.