Developers Turn to Mixed-use Developments to Fill Community Needs

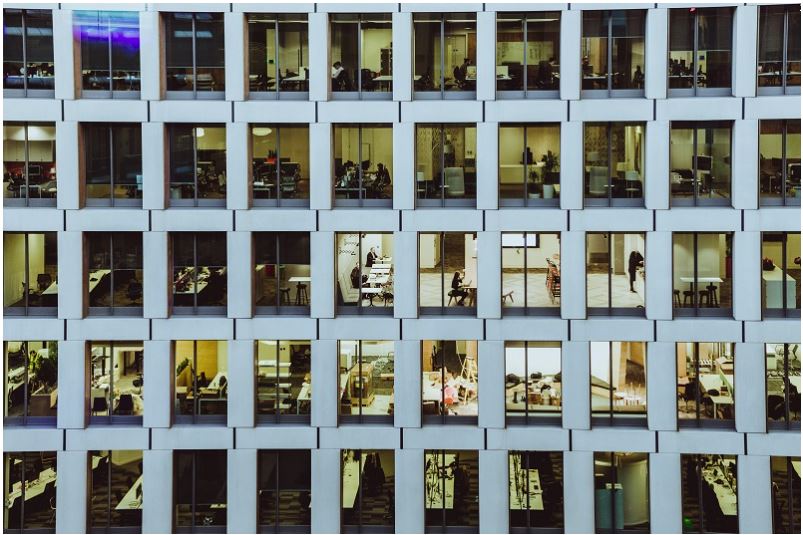

It’s difficult to fully explain the impact of the COVID-19 pandemic on commercial real estate. It changed consumer behavior in such a significant way, every sector was impacted in one way or another. Some, such as industrial, were strengthened, while sectors such as office and retail were forced to adapt to survive. Multifamily also saw a boom as it evolved to answer the needs of its residents, reinforcing a model that’s been growing in popularity: mixed-use developments.

“There has been a big push for live-work-play and mixed-use communities over the past decade, fueled by a number of factors including a preference for many professionals to live and work in the same community, which significantly reduces commute time to and from work,” said Srinath Pai Kasturi, Executive Vice President of Cadence McShane, which is recognized as one of the largest multifamily builders in the nation.

He added that since the pandemic, the trend of working from home is more of a reality now than it has ever been.

“Although many companies are currently requiring employees to report back to work in person, most companies have recognized certain efficiencies with remote workplaces and are allowing for some type of hybrid model in order to attract and retain top talent,” Kasturi said. “In response to this, developers are building communities that cater to new resident preferences by offering a more holistic community environment where residents can enjoy the most common amenities at their fingertips, with additional amenities including transit, retail, and entertainment all within walking distance.” Click to read more at www.rednews.com.