Medify Health LLC leased 2,178 square feet at 12221 Merit Drive in Dallas, Texas. Alex Houston represented the landlord, Hartman Income REIT.

Your Marketing Source For Texas Commercial Real Estate Reaching 100,000+ QUALIFIED Commercial Real Estate Brokers, Investors, Developers & Commercial Service Providers

Medify Health LLC leased 2,178 square feet at 12221 Merit Drive in Dallas, Texas. Alex Houston represented the landlord, Hartman Income REIT.

The acquisition represents another Texas multifamily purchase by Cove Capital as it continues to build a portfolio of debt-free multifamily offerings for accredited investors seeking Delaware Statutory Trust 1031 Exchange or Direct-Cash real estate Investments.

LOS ANGELES, Sept. 16, 2022 /PRNewswire/ — Cove Capital Investments, LLC, a DST Sponsor Company specializing in debt-free Delaware Statutory Trusts (DSTs) and other investment offerings for accredited investors, announced it has completed the purchase of a 159-unit, 130,128 square foot value-add multifamily community in the growing Dallas Fort-Worth area.

Cove Capital a DST Sponsor Company specializing in debt-free Delaware Statutory Trusts (DSTs) and other investment offerings for accredited investors announced it has acquired a value-add multifamily asset for its Cove Dallas 59 DST.

Cove Capital a DST Sponsor Company specializing in debt-free Delaware Statutory Trusts (DSTs) and other investment offerings for accredited investors announced it has acquired a value-add multifamily asset for its Cove Dallas 59 DST. Click to read more at www.prnewswire.com.

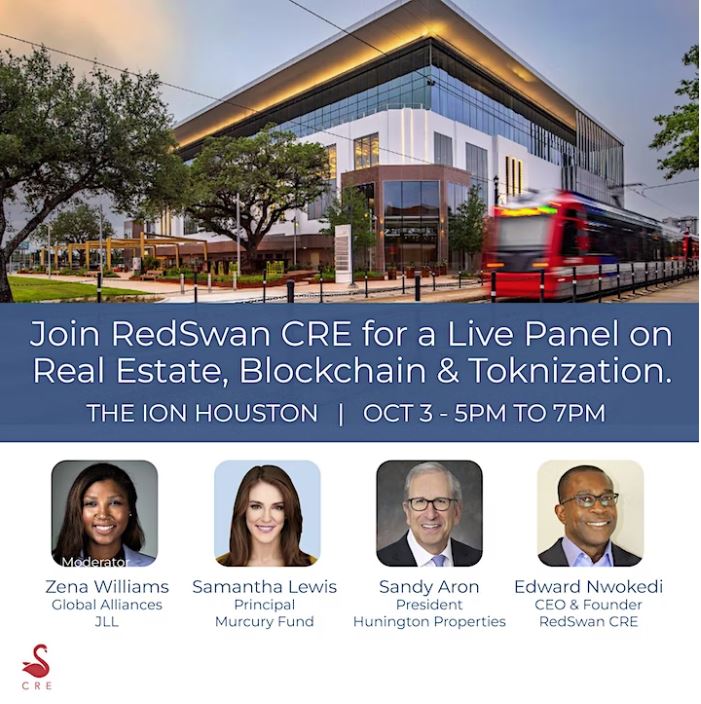

Blockchain, tokenization and real estate will be the themes of the panel discussion. Our guests represent all aspects of the commercial real estate industry; from property owners, brokerages, developers and venture capital. More Event Information

Our Panelists and Moderator:

Samantha Lewis (Panelist)

Principal – Mercury Fund

Sandy Aron (Panelist)

President of Hunington Properties

Edward Nwokedi (Panelist)

Founder and CEO, RedSwan CRE Marketplace

Zena T.P. Williams (Moderator)

JLL – Global Alliances

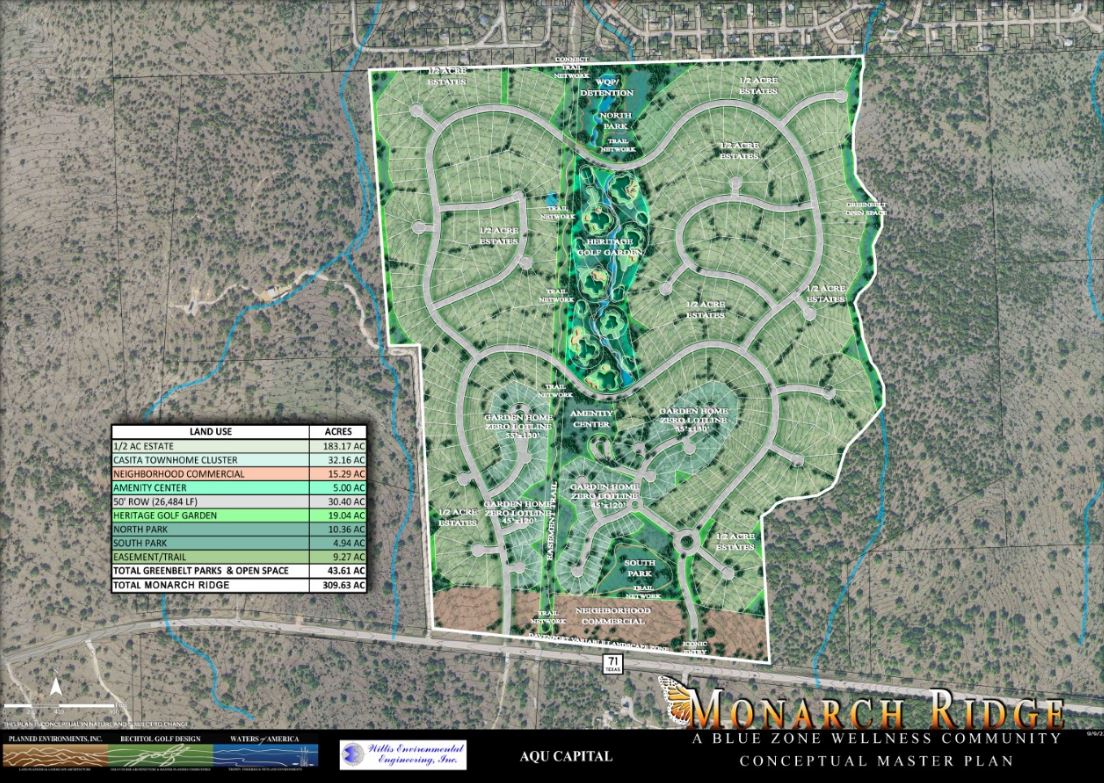

The conceptual master plan for Monarch Ridge, a 309-plus-acre community on Texas 71 in the extraterritorial jurisdiction of Horseshoe Bay.

(MARBLE FALLS, TX) — Monarch Ridge, a master-planned, 309-plus-acre community on Texas 71, was welcomed to the Texas Hill Country by the Horseshoe Bay City Council, which approved the development at a meeting Tuesday, Aug. 30. The first large development in Horseshoe Bay in years, Monarch Ridge is the work of Houston-based Aqu Capital. Headed by President Srinivasa Gogineni of Houston, the company has years of

experience in the industry.

With wide-open views of the Hill Country and Lake LBJ, Monarch Ridge has devoted over 43 acres to open space. Amenities include a vast network of walking trails; a six-hole, par-3 Heritage Golf Garden; a 5-acre amenity

center; and numerous parks and water features — all designed to complement and enhance the surrounding countryside.

Site plans include 45- and 55-foot garden home/casita lots and one-half-acre estate home lots, along with 15 acres zoned neighborhood commercial.

It is ideally situated between Horseshoe Bay and Baylor Scott & White Medical Center-Marble Falls and offers easy access to Austin, just a short drive east on Texas 71, and to San Antonio, a quick trip south on U.S. 281.

“Monarch Ridge is well positioned for easy country living with the ease of commuting,” Gogineni said. “I thought this would be the perfect location to bring to life a community I can also call my home.”

Based out of the Houston area, the developers are working closely with local land planner Roy Bechtol of Planned Environments LLC and local engineer Tony Plumlee of Willis Engineering. Rounding out the team are

Prabha Cinclair with Miklos Cinclair PLLC as development counsel and Patrick Bourne of Sundance Analytics as PID consultant. Zina Rodenbeck with Zina & Co. Real Estate of Marble Falls is the chosen real estate broker. The approved builder list is in the development stages as Builders are currently being interviewed. For additional information, contact Zina Rodenbeck directly at 830-265-0310.

A new Dallas initiative aims to bring minority real estate developers to the forefront. On Wednesday, Innovan Neighborhoods launched the Community Developers Roundtable to address gaps in affordable housing and community development.

It was an opportunity South Dallas native Jason Brown didn’t want to miss – to be in a room with other developers who look like him and have similar stories.

Brown is President and CEO of Dallas City Homes, a nonprofit community development organization. He credits an encounter years ago for leading him down this path.

“I’m in this position now because of someone that came to my career day back in middle school who was just talking about their involvement in commercial real estate and their niche in the market,” he said.

Commercial and multifamily mortgage delinquencies declined in the second quarter of 2022, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Delinquency Report.

“Delinquency rates for commercial and multifamily mortgages fell again during the second quarter of 2022,” said Jamie Woodwell, MBA’s Vice President of Commercial Real Estate Research. “Many capital sources are seeing delinquency rates at or approaching pre-pandemic levels, which were some of the lowest delinquency rates on record. MBA survey data have shown significant differences by property type as the COVID-19 pandemic’s effects have morphed. These property-type differences, particularly across changing economic conditions, will continue to be a key factor in commercial and multifamily loan performance.”

MBA’s quarterly analysis looks at commercial/multifamily delinquency rates for five of the largest investor-groups: commercial banks and thrifts, commercial mortgage-backed securities (CMBS), life insurance companies, and Fannie Mae and Freddie Mac. Together, these groups hold more than 80 percent of commercial/multifamily mortgage debt outstanding. MBA’s analysis incorporates the measures used by each individual investor group to track the performance of their loans. Because each investor group tracks delinquencies in its own way, delinquency rates are not comparable from one group to another. As just one example, Fannie Mae reports loans receiving payment forbearance as delinquent, while Freddie Mac excludes those loans if the borrower is in compliance with the forbearance agreement. Click to read more at mba.org.