Multifamily investors are bracing for an uptick in mortgage rates and other forms of real estate finance as the Federal Reserve bumps up interest rates in 2022. As an inflation-fighting move, the Fed plans three hikes of 25 basis points each. And in December, the Fed announced that it would wind down its bond-buying program by March.

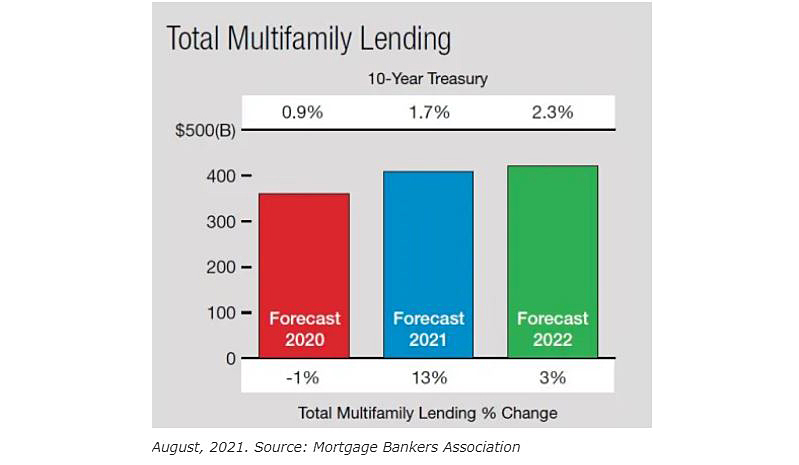

But the consensus among mortgage bankers and economists is that increases in the cost of capital will be modest and will not dampen the availability of financing or the surge of investment. Multifamily lending volume will rise 3 percent to $421 billion this year as the economy continues to rebound, the Mortgage Bankers Association projects.

“The change in interest rates is not expected to reduce demand for multifamily housing this year. A lot of demand is driven by property values and fundamentals, both of which are extremely strong right now,” said Jamie Woodwell, MBA’s vice president of commercial real estate research. Strong property income and low vacancy are combining to push valuations upward, he added. Click to read more at www.multihousingnews.com.