Dallas, TX (April 21, 2022) — Newmark announces the sale of a 264-unit, luxury

multifamily community, Ashford, located in suburban Dallas. The townhome-style property traded from Pegasus Real Estate, a private commercial real estate investment firm, to an undisclosed buyer. Newmark Vice Chairman Brian Murphy, Executive Managing Director Brian O’Boyle, Jr. and Senior Managing Directors Richard Furr and Jakob Andersen facilitated the transaction.

“As the top U.S. multifamily investment market in 2021 in terms of transaction volume*, Dallas continues to perform exceptionally well, as we wrap the first quarter of the year,” said Murphy. “With amenity-rich properties continuing to attract investor demand, Ashford was highly sought after—we are thrilled with the successful transaction for all parties.”

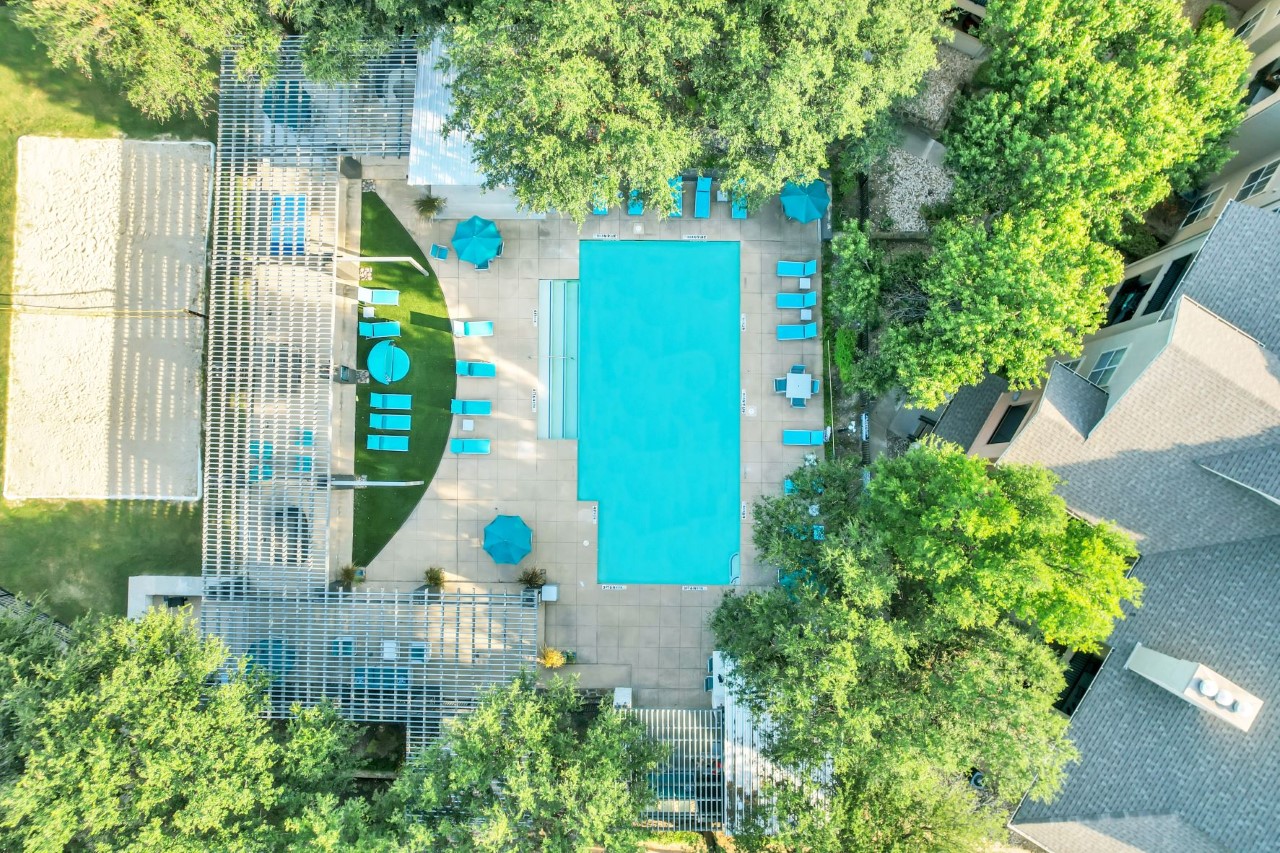

Built in 1995, Ashford features a mix of large one- and two-bedroom units with an average unit size of 985 square feet. Units feature garages, nine-foot ceilings, faux wood flooring, fireplaces, spacious closets, and balconies or patios with storage. Community amenities include a community center with fireplace, kitchen and outdoor seating; pool with lounge area, barbeque grills and covered pergola with seating; fitness center; dog park and outdoor lounge area with fireplace.

“We were originally attracted to this property because of its low-density two-story buildings with attached garages, brick carports and beautiful water features,” said Jonas Levy, Managing Partner of Pegasus Real Estate. “We think these unique features and the property’s central location and high-quality demographics will allow the buyer to continue the positive momentum at the property.”

“We are proud to have executed on our business plan to improve this asset and realize substantial value for our investors,” added Justin Laub, Managing Partner of Pegasus Real Estate. “Newmark did an excellent job finding a buyer who is a great fit for this property.”

Located at 2116 Marsh Lane in Carrollton, Texas, the property is within a 30-minute commute to prime employment centers featuring 3.3 million jobs. Major employers in the area include Toyota, FedEx Office, JPMorgan Chase, Liberty Mutual, Mary Kay and United Surgical Partners. Residents have access to numerous shopping and entertainment amenities at the nearby Shops at Willow Bend, Galleria Dallas, Marsh Lane Golf Center, Bent Tree Country Club and Preston Trail Golf Club.

Multifamily rent growth was historically strong in 2021, according to Newmark Research, as asset owners were able to raise rents well above pre-pandemic levels. Annualized effective rent growth for the U.S. averaged 6.8% in 2021, with Sunbelt markets such as Dallas outperforming with a 16.5% growth rate over the year.

*According to Newmark Research’s 4Q21 United States Multifamily Capital Markets Report

Press Contact: Lizzy Mahan t 303-260-4437 lizzy.mahan@nmrk.com