Investors remain eager to sink their dollars into commercial real estate as 2026 begins. But uncertainty over tariffs, interest rates and high construction costs are preventing more from pulling the trigger on deals.

That’s one of the big takeaways from Coldwell Banker Commercial’s 2026 Outlook Report, a deep dive look at commercial real estate trends in the United States.

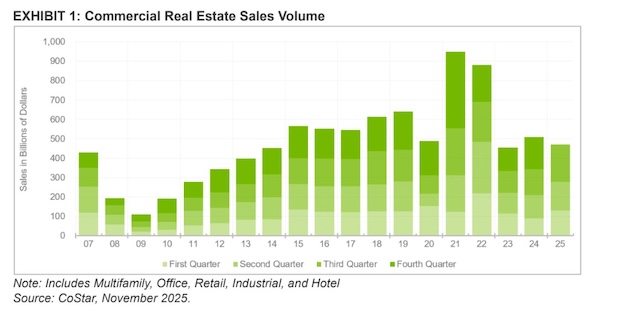

According to Coldwell Banker Commercial’s report, commercial real estate activity increased in the second half of 2025. But overall transaction volume remains low as 2026 begins.

The hope for this year? Coldwell points to the looming refinance wave — citing $957 billion in maturities — as a possible catalyst for fueling a jump in CRE transactions in 2026.

Other key findings from the report? Here’s what Coldwell Banker Commercial pointed to as some of its most interesting:

Interest is high, closings are not. Investor and user interest has increased, but tariffs, interest rates, and elevated construction costs continue blocking transactions. Owners/users are paying premiums and entering bidding wars to secure growth space.

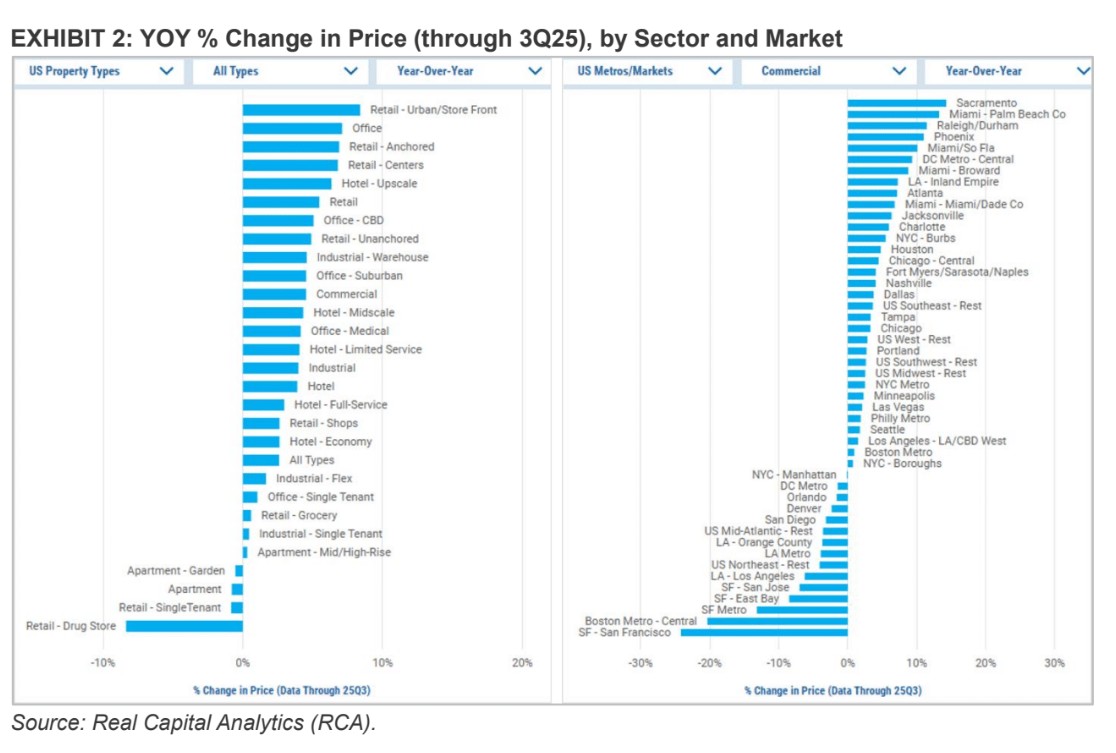

Smaller properties are hot in growth markets. Coldwell Banker Commercial reports significant price increases for small spaces across retail, office and industrial in markets with strong population and wage growth. Land activity is elevated as residential developers compete with data center and logistics users for properly zoned sites.

Economic warning signs emerging. Unemployment hit 4.4% in November 2025, its highest level in four years. Despite strong consumer spending, consumer confidence is declining, likely because of high personal debt and persistent inflation.

Transaction volume up, but unevenly. Total U.S. CRE volume reached $385.7 billion through October 2025, up 13% YoY (MSCI Real Assets). Development sites, office, retail and senior housing outperformed, while multifamily and industrial lagged.

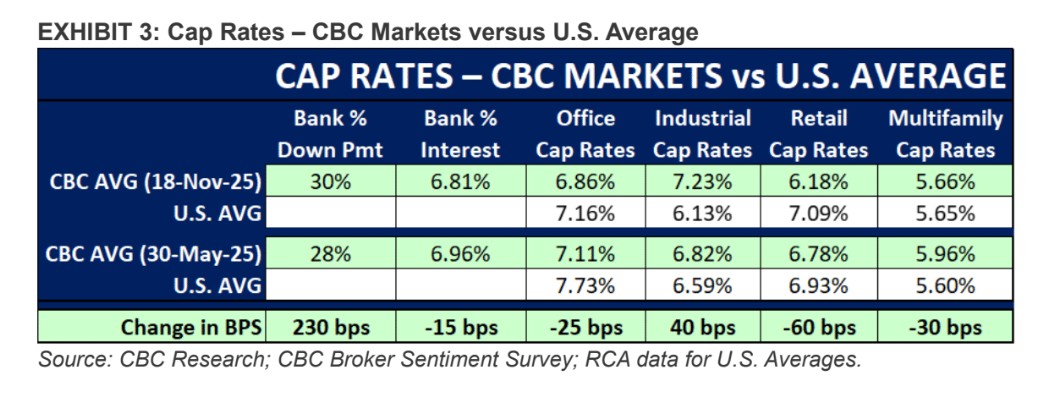

Cap rate spreads widening. Multifamily cap rates are lowest at 5.6%, industrial at 6.4%, and office highest at 7.5% (Real Capital Analytics). Retail cap rates dropped 60 bps over six months, while industrial rose 40 bps.