“Capital flows are still robust for industrial assets despite some near-term headwinds as the sector continues to show strength on the user (leasing) demand side and reasonable new construction pipelines. We believe that the central part of the country, including SE Texas, are well positioned for robust future industrial growth as the Gulf of Mexico Ports and North/South rail options push more distribution from the backlogged West Coast to this region.” Patrick Duffy | President of Colliers in Houston

Key Takeaways

- Robust leasing activity

- Positive net absorption

- Vacancy drops

- Rental rates increase

- Construction starts up

Houston Highlights

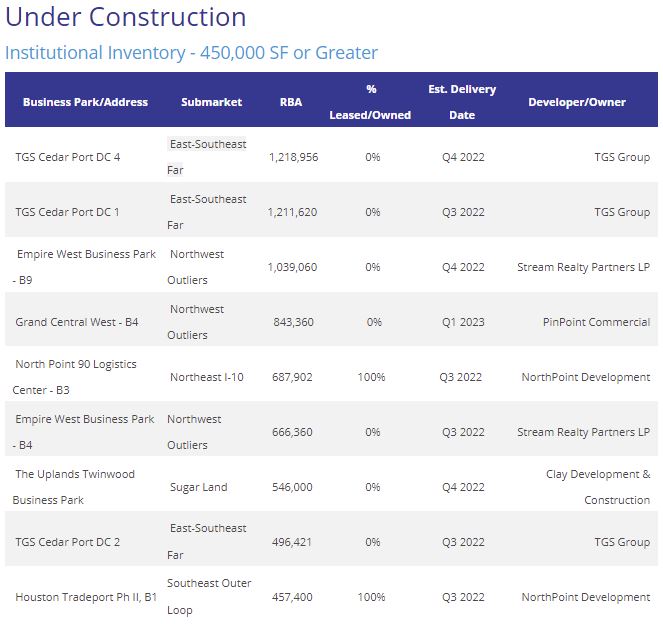

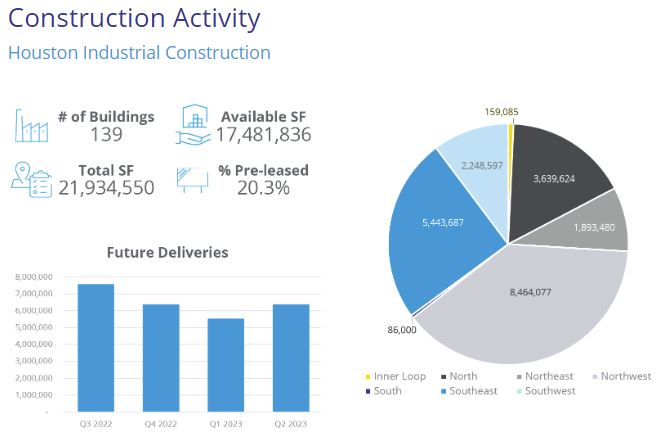

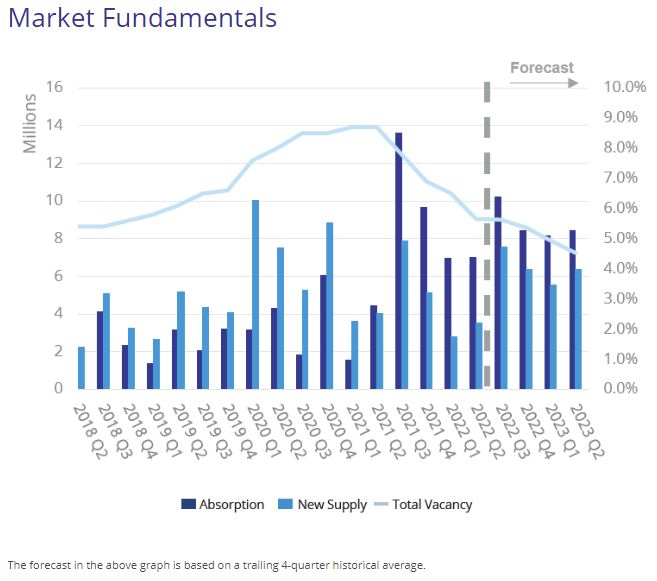

Houston’s industrial market continued to gain momentum as leasing velocity reached over 10 million square feet in the second quarter. The increase in demand for space continued to spur new development with over 21 million square feet under construction and an additional 65 million square feet proposed or in the final planning stage. Houston’s industrial market recorded 6.6 million square feet of positive net absorption in the second quarter. The vacancy rate decreased 280 basis points annually from 8.5% in Q2 2021 to 5.7% in Q2 2022.

Executive Summary

Commentary by Jim Pratt

The headlines for the 2nd Quarter of 2022 might mimic a political campaign of yesteryear, “It’s the economy, stupid!” While that may be somewhat harsh, we are certainly in a period of dramatic change and uncertainty in the Houston industrial market. With inflation at 40-year highs, currently exceeding 9%, and YTD increases of 1.5% in the interest rates by the Fed, developers and investors alike are revising their investment parameters to reflect these significant shifts. While the appetite for investment doesn’t seem to be affected, there is a wider gap in Seller expectations and Buyer pricing that will likely grow through the end of the year. Further, additional increases in interest rates are expected to total 1.5% to 1.75% and should have a significant impact on valuations. As we are easing into a recession that could be exacerbated by the additional interest rate increases anticipated from the Fed, the impact of a national recession on the Houston economy, and more specifically the Houston industrial market, is unknown. We continue to have strong tailwinds that could likely carry us through without a huge impact.

International investment dollars are still pouring in as these investors are willing to accept lower returns in exchange for the safety of their investments. U.S. real estate is an excellent hedge against inflation and offers security. These investors may be muting the overall impact of rising interest rates on cap rates. While not rising point for point with interest rates, there is certainly movement in cap rates on most industrial real estate. Long-term debt has increased as much as 150 basis points, creating negative leverage where cap rates are lower than the interest rates on debt. To maintain the required debt coverage ratios, investors have to provide more equity with lower percentages of leverage to satisfy the lenders. All of these factors are affecting the pricing and will continue to have a more significant impact through the end of the year.

Nationally, according to the Wall Street Journal, property sales dropped 16% compared to April 2021. Prior to April of this year, sales had increased for thirteen consecutive months. The decline has been more pronounced in the Houston Industrial market. According to statistics from Real Capital Analytics, industrial sales dropped from 114 properties and $1,904,940,472 in the 4th quarter of 2021 to 57 properties and $1,549,963,942 in the 1st quarter of this year, and only 43 properties totaling $777,668,957 this quarter.

Aside from the drop-off in industrial sales, we have a very healthy industrial market. The vacancy rate dropped from 6.11% in the 1st quarter to 5.6% this quarter. Year-to-date absorption through the end of the 2nd quarter was 13,078,101 square feet, in line with the record setting absorption in 2021. More importantly, the average rental rate increased from $7.88 to $8.60 over the past quarter. Where annual increases in rental rates had recorded 2% for many years, they increased substantially and are now typically ranging within 3.5% to 4%. Owners are bolstering their returns as they try to offset the impact of inflation with larger increases in the rental rates.

Another trend continuing to take root in the market is the preference for shorter-term leases by landlords. Houston has historically seen 5-6% annual increases in rental rates, but the weighted rental rate change over the 1st quarter was 5.52%. Landlords are reluctant to commit to long-term leases that lock in fixed rental rate increases, preferring shorter-term leases that allow for more significant rental rate increases at the end of the lease term. While lenders still want longer-term commitments for a stabilized cash flow on new acquisition loans and ground-up development, current owners typically renew for shorter terms.

So, despite all of the changes in the economy, we believe the Houston industrial market is strong and adapting to the changing parameters. We will continue to watch the economy closely, and adjust to changes in the market, but with a solid foundation, the outlook for the balance of 2022 continues to be good.