BY RAY HANKAMER

rhankamer@gmail.com

RH: Welcome to RED News, David. You have been the Dean of the Houston Art Community for decades now, but most people don’t know that you have had a shrewd eye for real estate deals over the years. Before we get into that, though, can you give our readers a summary of your career in painting and sculpture, including your early studies?

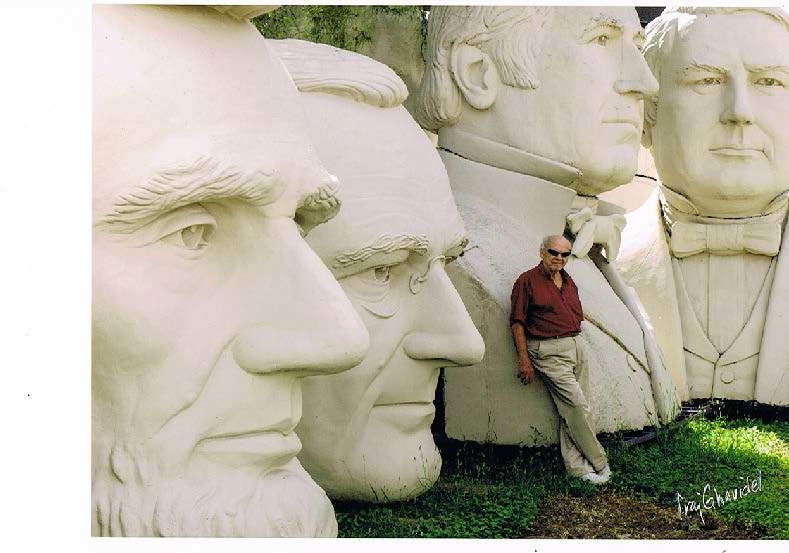

David Adickes: Yes…I studied painting in Paris with Fernand Leger, one of the modern biggies, for two years: 1948-50. I returned to Houston and had shows at several galleries and museums, including the Museum of Fine Art. The first big sculpture I did was for real estate developer Joe Russo at his Lyric Center building, The Cellist.

Joe was unsure if he had done the right thing putting this large sculpture up. (I wired it to ‘play’ classical music for about twelve hours a day.) About the same time, other building owners had put up large expensive sculptures by Miro and Dubuffet, one of which cost $1 million, so Joe commissioned a Houston poll to see where his The Cellist ranked of these three. It topped the list with 85% approval, so he was happy!

Click here to read the rest of this Article.