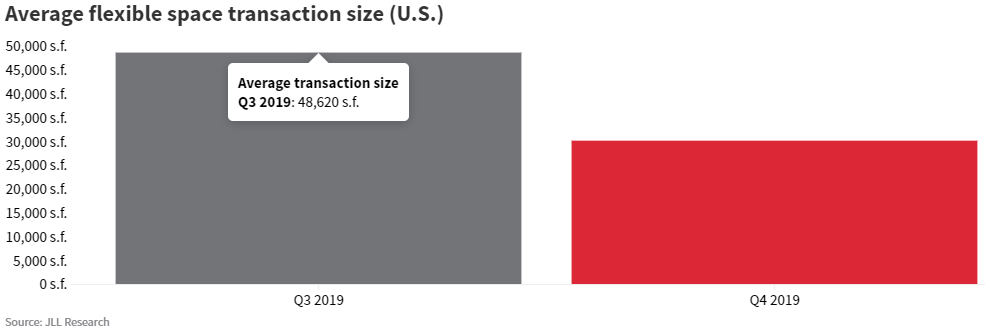

The falloff in WeWork’s leasing activity in the fourth quarter dragged down the average flexible space transaction size from 48,620 s.f. in Q3 2019 vs. 30,117 s.f. in Q4, a decline of 38%. WeWork’s average deal size (69,625 s.f.) is significantly larger than most other flexible space operators (21,153 s.f.), and the more conservative, moderate growth of most operators is likely to result in typical flexible space transactions spanning a single floor or less, rather than the multiple floors WeWork typically leased at a time. Additionally, investor concerns regarding the share of flexible space within an asset is likely to restrict the size of transactions – at least until there is a better understanding of the business model and investors are able to underwrite coworking leases with greater certainty. Click to read more at www.us.jll.com.