As this article goes to press, the clock is ticking on two of the first significant deadlines connected to Opportunity Zones. The countdown is on to Dec. 31.

“The first issue is the 15-percent step-up in basis, which effectively gives you a 15-percent discount on your initial Capital Gains taxes that would be

due in December 2026. An example would be the sale of Netflix stock,” explains Craig Bernstein, Principal and Chief Investment Officer at OPZ

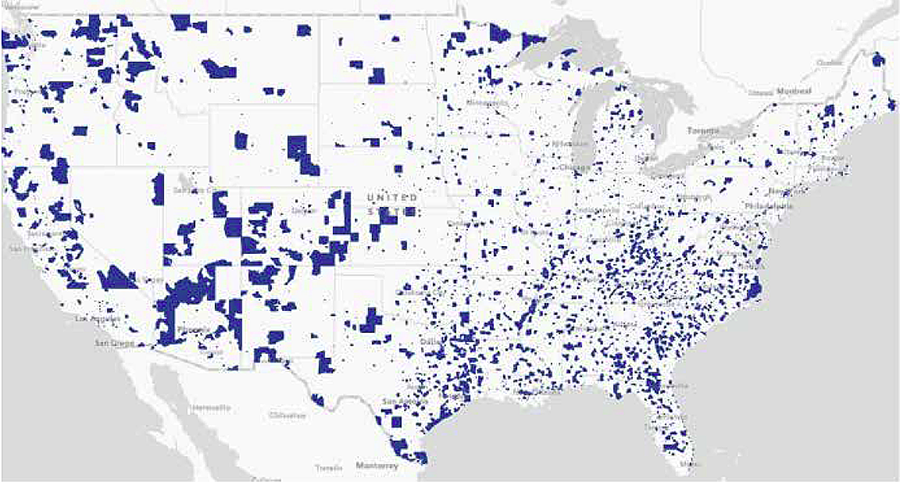

Bernstein, a Washington, D.C.-based real estate private equity fund that specializes in Qualified Opportunity Zone fund investments (“QOF”). That step-up in basis is a huge selling point of the Opportunity Zone program, created by the 2017 Tax Cuts and Jobs Act. By reinvesting Capital Gains in Qualified Opportunity Zone funds, investors are able to defer, reduce and, in some cases, eliminate any Long-Term Capital Gains taxes on the Opportunity Zone Fund investment. Click to read more at www.rednews.com.

Opportunity Zone Outlook: Expert Craig Bernstein Outlines His Expectations or The Program’s Future